Gracias por ser miembro

Hacer que sea fácil en línea

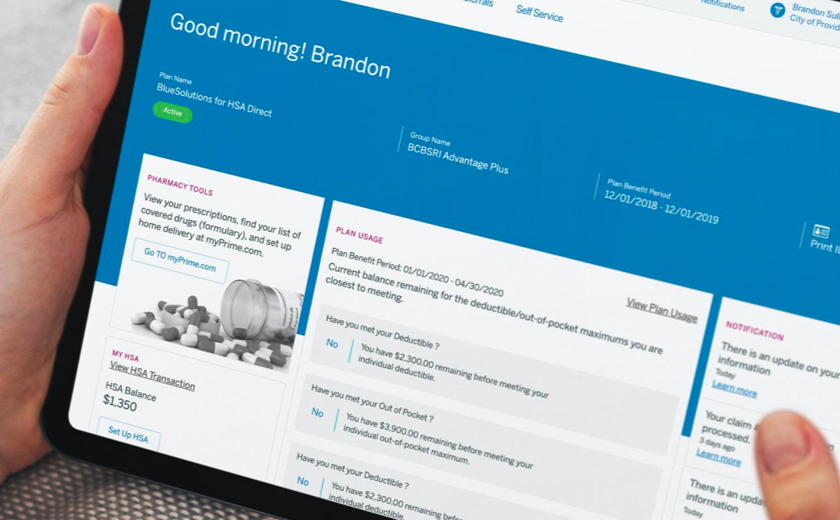

myBCBSRI es su enlace a casi todo lo que BCBSRI ofrece, y es el lugar donde puede ver sus beneficios y reclamaciones. Así que tómese unos minutos para registrarse.

¿Ya está registrado? Inicie sesión ahora

¿Busca información sobre el plan?

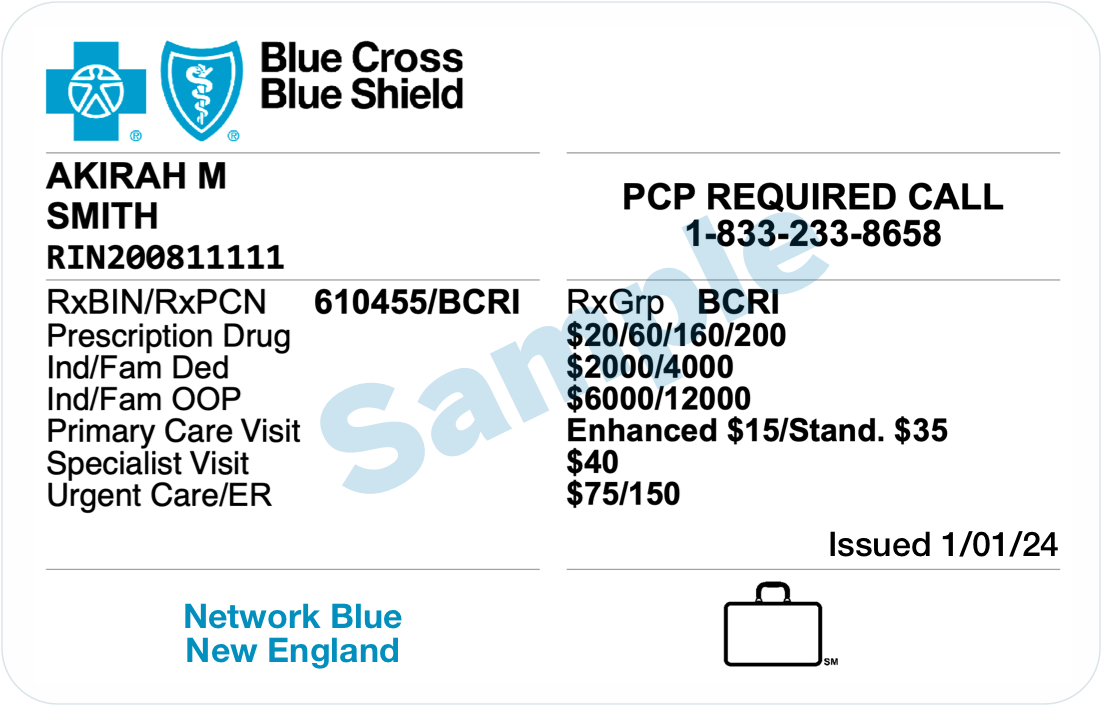

Encontrará el nombre del plan en la parte inferior de su tarjeta de identificación de miembro.

Access Blue New England

Acceda a Blue New England, un plan de salud con deducible alto y cobertura regional de Nueva Inglaterra. Con este plan, usted puede abrir una cuenta de ahorros de salud (HSA, por sus siglas en inglés), que le permite ahorrar dinero no gravado en gastos médicos calificados ahora o en el futuro.

Algunos aspectos destacados de su plan:

- Médicos, hospitales y laboratorios en Rhode Island, Connecticut, Maine, Massachusetts y Nuevo Hampshire

- Ventajas en sus impuestos al abrir una cuenta de ahorros de salud (HSA, por sus siglas en inglés)

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

- $0 por muchos servicios preventivos, como su examen físico anual, cuando ve a un proveedor de la red

- Cobertura completa para programas para dejar de fumar, perder peso y manejar afecciones como asma y diabetes

- El beneficio de medicamentos preventivos reduce los costos de bolsillo respecto de determinados medicamentos preventivos

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

Ahorre dinero con su HSA

Considere su HSA como una cuenta de retiro para gastos médicos. Puede agregar dinero a su cuenta y gastarlo ahora. O bien, puede continuar ahorrando e invirtiendo su dinero, y usarlo más adelante. De cualquier manera, usted obtiene una triple ventaja impositiva.

BlueCHiP Flex

BlueCHiP confía en un proveedor de atención primaria (PCP, por sus siglas en inglés) para coordinar todos sus servicios de salud. Los PCP lo guían a través del sistema de atención médica y proporcionan derivaciones a especialistas según sea necesario, para ayudar a garantizar el nivel adecuado de atención. Usted y su PCP trabajan en conjunto para identificar las necesidades de salud y ayudar a evitar que las enfermedades menores se conviertan en problemas graves.

Algunos aspectos destacados de su plan:

- Un proveedor de atención primaria (PCP, por sus siglas en inglés), que es el médico al que usted acude habitualmente y que proporciona derivaciones para especialistas, pruebas y algunos otros servicios según sea necesario

- Copagos de $0 por visitas a su PCP si pertenece a un hogar de salud centrado en el paciente (PCMH, por sus siglas en inglés)

- Una red de Rhode Island que incluye todos los hospitales del estado, 1,550 PCP y 3,800 especialistas

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

¿Necesita una referencia?

Su atención médica en este plan se basa en derivaciones de su PCP, pero algunos tipos de atención, como servicios de salud mental y de emergencia, no necesitan derivación.

Blue Choice New England

Blue Choice New England ofrece primas bajas y la comodidad de la atención coordinada con un proveedor de atención primaria (PCP, por sus siglas en inglés). También tiene la flexibilidad adicional de elegir proveedores fuera de la red. Si bien usted tiene los costos de bolsillo más bajos cuando la atención está a cargo de un PCP, puede tomar la decisión de buscar atención autodirigida y pagar más.

Algunos aspectos destacados de su plan:

- Un proveedor de atención primaria (PCP, por sus siglas en inglés), que es el médico al que usted acude habitualmente y que proporciona derivaciones para especialistas, pruebas y algunos otros servicios según sea necesario

- Médicos, hospitales y laboratorios en Rhode Island, Connecticut, Maine, Massachusetts y Nuevo Hampshire

- Menores costos si opta por los proveedores dentro de la red

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

- $0 por muchos servicios preventivos, como su examen físico anual, cuando ve a un proveedor de la red

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

¿Necesita una referencia?

Su atención médica en este plan se basa en derivaciones de su PCP, pero algunos tipos de atención, como servicios de salud mental y de emergencia, no necesitan derivación.

BlueHPN

Blue High Performance NetworkSM (BlueHPN) se centra en una atención de calidad a un costo más bajo. Por lo tanto, ofrece una red que consta de proveedores con un gran desempeño que se seleccionan en función de la calidad profesional y la rentabilidad. Tiene el compromiso de brindar atención para ayudar a mejorar su salud tanto hoy como en el futuro. Y eso puede reducir los costos generales de la atención médica.

Algunos aspectos destacados de su plan:

- Una red local de proveedores elegidos por su alto nivel de calidad y rentabilidad

- Redes de proveedores en las principales ciudades de los EE. UU.

- Acceso al cuidado de emergencia en todo el país

- Sin necesidad de derivaciones

- Copagos predecibles para visitas al consultorio con el plan tradicional

- Posibilidad de abrir una cuenta de ahorros de salud con el plan de salud con deducible alto

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

La red de su plan

BlueHPN ofrece un alcance a nivel nacional con cobertura en 55 de las áreas metropolitanas más grandes del país. Cada mercado de BlueHPN, lo que incluye Rhode Island y el área metropolitana de Boston, tiene una red local que consta de proveedores con un gran desempeño que se seleccionan en función de la calidad profesional y la rentabilidad, además de la integración con otros proveedores, lo que puede traducirse en mejores resultados y costos reducidos.

Ahorre dinero con su HSA

Considere su HSA como una cuenta de retiro para gastos médicos. Puede agregar dinero a su cuenta y gastarlo ahora. O bien, puede continuar ahorrando e invirtiendo su dinero, y usarlo más adelante. De cualquier manera, usted obtiene una triple ventaja impositiva.

BlueSolutions

BlueSolutions es un plan de salud con un deducible alto que ayuda a mantener primas razonables y, al mismo tiempo, ofrece beneficios integrales. Y con este plan, usted puede abrir una cuenta de ahorros de salud (HSA, por sus siglas en inglés) con ventajas impositivas para pagar gastos médicos calificados con dinero exento de impuestos.

Algunos aspectos destacados de su plan:

- Obtiene ventajas en sus impuestos al abrir una cuenta de ahorros de salud (HSA, por sus siglas en inglés)

- $0 por muchos servicios preventivos, como su examen físico anual, cuando ve a un proveedor de la red

- Cobertura completa para programas para dejar de fumar, perder peso y manejar afecciones como asma y diabetes

- El beneficio de medicamentos preventivos reduce los costos de bolsillo para determinados medicamentos preventivos si su empleador seleccionó este beneficio

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

Ahorre dinero con su HSA

Considere su HSA como una cuenta de retiro para gastos médicos. Puede agregar dinero a su cuenta y gastarlo ahora. O bien, puede continuar ahorrando e invirtiendo su dinero, y usarlo más adelante. De cualquier manera, usted obtiene una triple ventaja impositiva.

HealthMate Coast-to-Coast

HealthMate Coast-to-Coast le ofrece cobertura para muchos servicios con copagos o coseguros fijos en dólares. Con su tarjeta de identificación de miembro, tiene acceso a miles de proveedores en todo el país.

Algunos aspectos destacados de su plan:

- $0 por muchos servicios preventivos, como su examen físico anual, cuando ve a un proveedor de la red

- Copagos predecibles para muchos servicios

- Menores costos si opta por los proveedores dentro de la red

- Acceso a una extensa red nacional

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

Prevención de $0

Usted puede hacer una gran diferencia en su salud al obtener la atención preventiva que necesita. Los exámenes físicos anuales, análisis de rutina y muchos más servicios pueden costarle nada de gastos de bolsillo cuando reciba los servicios dentro de la red.

Network Blue New England

Network Blue New England confía en un proveedor de atención primaria (PCP, por sus siglas en inglés) para coordinar todos sus servicios de salud. Los PCP lo guían a través del sistema de atención médica y proporcionan derivaciones a especialistas según sea necesario, para ayudar a garantizar el nivel adecuado de atención. Los PCP y los miembros trabajan en conjunto para identificar las necesidades de salud y ayudar a evitar que las enfermedades menores se conviertan en problemas graves.

Algunos aspectos destacados de su plan:

- Un proveedor de atención primaria (PCP, por sus siglas en inglés), que es el médico al que usted acude habitualmente y que proporciona derivaciones para especialistas, pruebas y algunos otros servicios según sea necesario

- Médicos, hospitales y laboratorios en Rhode Island, Connecticut, Maine, Massachusetts y Nuevo Hampshire

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

- $0 por muchos servicios preventivos, como su examen físico anual, cuando ve a un proveedor de la red

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

¿Necesita una referencia?

Su atención médica en este plan se basa en derivaciones de su PCP, pero algunos tipos de atención, como servicios de salud mental y de emergencia, no necesitan derivación.

VantageBlue

VantageBlue proporciona beneficios tradicionales con incentivos que promueven una vida saludable y alientan a los miembros a asumir un papel activo en la atención médica que reciben.

Algunos aspectos destacados de su plan:

- Copago de $0 para su primera visita por enfermedad con su proveedor de atención primaria (PCP)

- Copago de $2 por determinados fármacos de mantenimiento genérico para tratar diabetes, asma y enfermedad pulmonar obstructiva crónica (EPOC)

- Programa de ahorros en medicamentos recetados MedsYourWay®, sin necesidad de cupones ni tarjetas de descuento; y todas las compras de medicamentos recetados cubiertos cuentan para su deducible (si corresponde) y desembolso directo máximo.* Simplemente enseñe su tarjeta de identificación de miembro de BCBSRI si tiene beneficios farmacéuticos a través de BCBSRI

- Cobertura de hasta 20 visitas para atención quiropráctica por miembro por año

- Cobertura completa para programas para dejar de fumar, perder peso y manejar afecciones como asma y diabetes

- Cobertura de hasta 30 sesiones de fisioterapia/terapia ocupacional y terapia del habla por miembro por año

*MedsYourWay no es un seguro. Es un programa de descuentos en medicamentos administrado por Prime Therapeutics, LLC, una empresa independiente contratada por BCBSRI para proporcionar servicios de administración de beneficios farmacéuticos. Pregunte si su farmacia participa de MedsYourWay antes de surtir su receta.

Prevención de $0

Usted puede hacer una gran diferencia en su salud al obtener la atención preventiva que necesita. Los exámenes físicos anuales, análisis de rutina y muchos más servicios pueden costarle nada de gastos de bolsillo cuando reciba los servicios dentro de la red.

Conozca lo básico

Consulte la sección de miembros de nuestro sitio web para obtener prácticos consejos, formularios e información sobre las ventajas de su plan. Luego guárdelos como favoritos para referencia futura. Mientras tanto, le explicamos cómo:

(el documento que dice “esto no es una factura”)

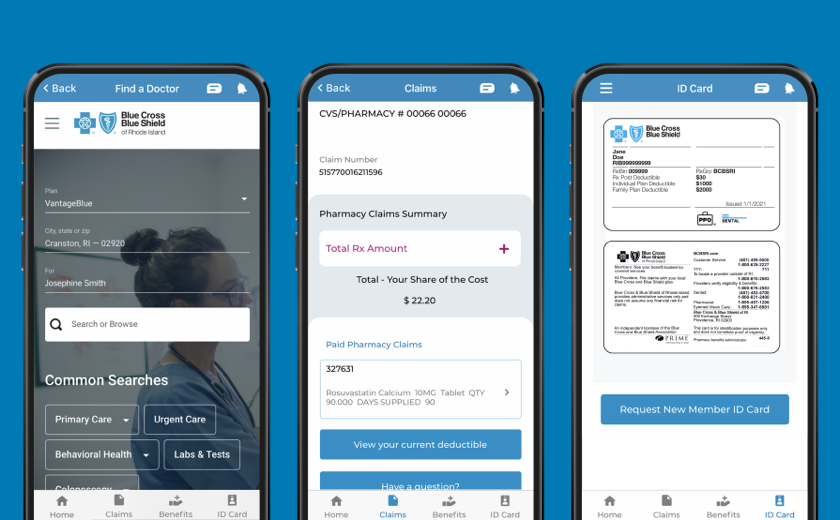

Solicite ayuda

No tiene que ser un experto. Estamos aquí para ayudarle cuando lo necesite, incluso los fines de semana. Envíenos un mensaje a través de myBCBSRI. O bien, Llame al número que se encuentra al dorso de su tarjeta. O bien, visite una ubicación de Your Blue Store cerca de su domicilio para recibir asistencia en persona.